Stamp Duty on Additional Residential Properties

In his Autumn Statement last year, George Osbourne set out changes to the stamp duty payable on additional residential properties and such changes came into effect on 1 April 2016.

What are the changes?

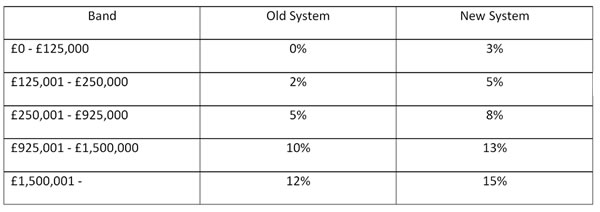

In broad terms, second home owners and landlords face paying 3% more on all stamp duty bands for all properties purchased.

For example, if a landlord purchased a residential property at a price of £150,000 prior to the changes, the stamp duty would have been calculated at 2% of £25,000 (the portion of the price within the 2% band), leading to duty payable of £500. Now, the stamp duty would be calculated based on 3% of £125,000 (the portion of the price within the 3% band) plus 5% of £25,000 (the portion of the price within the 5% band), leading to stamp duty payable of £5,000.

When does the new system come into force?

The new system is in force from 1 April 2016, excepting any sales still to complete in which contracts were exchanged before 25 November 2015.

What if a company is used to purchase a residential property?

Companies will be subject to the new rates for any purchase of a residential property, not simply for additional properties.

What if I am buying a new home but keeping my previous home?

If you are buying an additional property and at the end of the day of purchase of the new property you still own your previous home, you will be liable to pay the increased rates. You will however be entitled to apply for a refund of the increased rates if you sell your previous home within 36 months.

What if I am replacing my home but have more than one property?

If you already own a number of residential properties and you are buying a replacement for your home which is sold at the same time then you will not be liable for the increased rates.

What if I am selling my home prior to replacing it?

If you already own a number of residential properties and you sell your main home prior to replacing it, you will be liable to pay the increased rates. However, if you purchase the replacement main home within 36 months you will be able to apply for a refund of the increased amount.

Further Advice

For further advice or guidance in relation to stamp duty and how it might apply to you, please contact Patrick Keown or Katie Kane in our Belfast office.

Back to News Headlines